- Report Index

- Actions and Results of TSE and Listed Companies to Improve P/B Ratio

- DLRI Report

-

2024.2

Actions and Results of TSE and Listed Companies to Improve P/B Ratio

Yoshio Kawatani

Actions of TSE and Listed Companies

On January 15, 2024, the Tokyo Stock Exchange (TSE) published a list of companies that have disclosed information regarding “Action to Implement Management that is Conscious of Cost of Capital and Stock Price.” TSE has identified a concern that the Price/Book (P/B) ratios of major Japanese companies are lower compared to those in Europe and the U.S. In response , at the end of March 2023, they requested all companies listed on the TSE Prime and Standard Market to implement management that is conscious of the cost of capital and stock prices, and to disclose the status of actions. The publication of this list is a list of companies that have responded to this request by the end of December 2023, and will be updated on a monthly basis.

About half of the Prime Market companies have already complied with the request

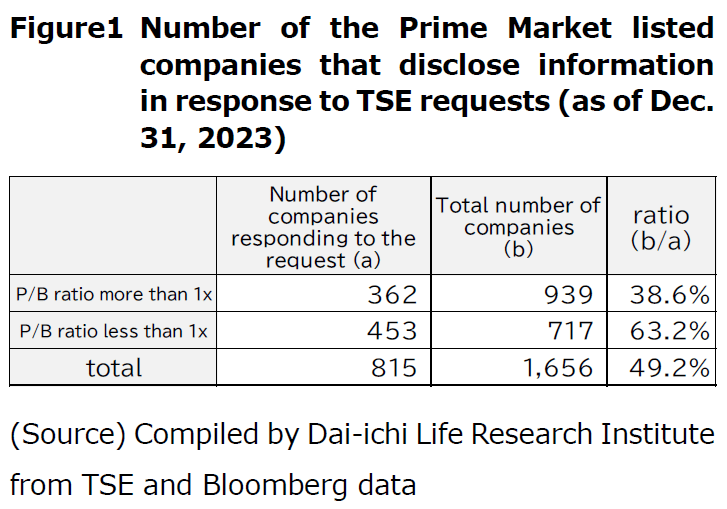

Figure 1 is a compilation of the Prime Market listed companies from the list published on January 15.

Of the 1,656 companies listed on the Prime Market as of December 31, 2023, 815 companies have complied with the TSE's disclosure requests. It was initially understood that this request was for companies with a P/B ratio of less than 1x. Although these companies have a higher percentage of correspondence, nearly 40% of the companies with P/B ratios of 1x or more also corresponded.

How are the results of this effort?

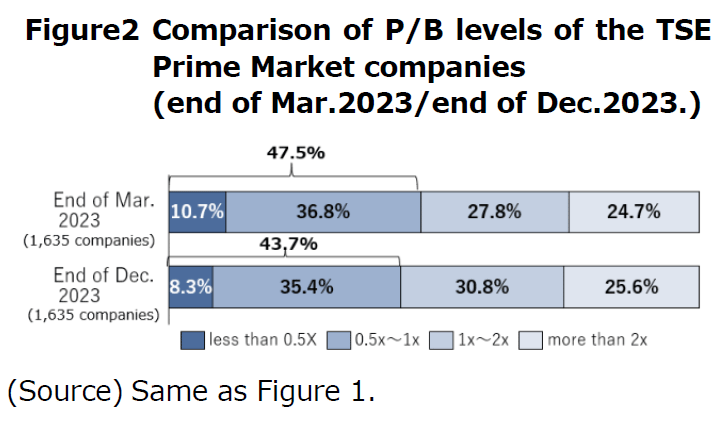

The Japanese stock market has recently been revitalized and stock prices are at their highest level since the burst of the bubble economy. This is said to be partly due to this action. Figure 2 compares the difference the level of P/B ratios the of Prime Market as a whole between the end of March 2023 and the end of December of the same year. In order to exclude the impact of companies entering and exiting the during this period, 1,635 companies that have been continuously listed on the Prime Market are included.

It is true that the proportion of companies with P/B ratios of less than 1x has decreased by about 4% ppt, but this cannot be simply attributed to this action, since stock prices are higher in the market as a whole, including companies that have not yet taken action.

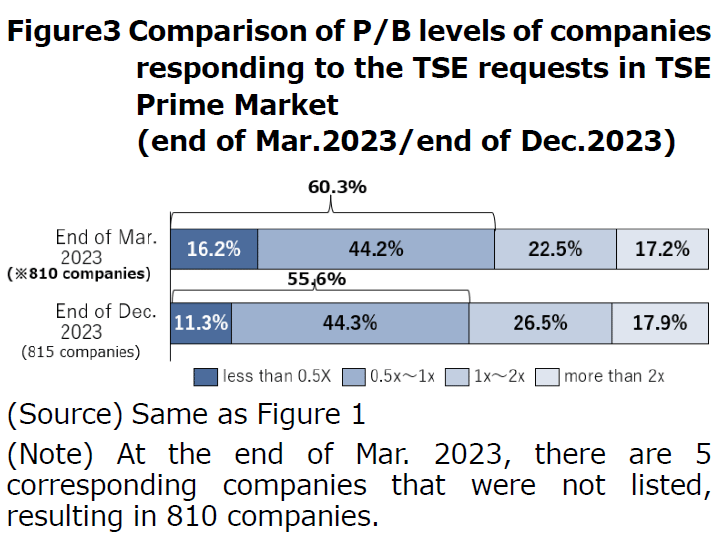

Figure3 compares the level of P/B ratios at the end of March 2023 and at the end of December 2023 for the 815 companies that have already responded to the TSE's request for disclosure, as in figure2.

The percentage of companies with a P/B ratio of less than 1x decreased by about 5% pt. Although the percentage decrease is slightly larger than the overall decrease, it is not a marked difference.

Results of action should be viewed from a medium- to long-term perspective

Certainly, stock prices have been rising recently, and the level of P/B ratios of listed companies has been improving. We cannot deny the possibility that the actions of TSE and listed companies are a contributing factor. However, for this achievement to become full-fledged, dialogue with investors based on disclosure must progress, and management that is broadly aware of the cost of capital and stock price must take root.

The results of the actions of TSE and listed companies should probably be evaluated over the medium to long term, not in terms of short-term stock prices.

Original in Japanese:

https://www.dlri.co.jp/report/dlri/316655.html

Disclaimer:

This report has been prepared for general information purposes only and is not intended to solicit investment. It is based on information that, at the time of preparation, was deemed credible by Dai-ichi Life Research Institute, but it accepts no responsibility for its accuracy or completeness. Forecasts are subject to change without notice. In addition, the information provided may not always be consistent with the investment policies, etc. of Dai-ichi Life or its affiliates.